Data Brief

Protecting Bonds to Build Infrastructure and Create Jobs

Data brief by the Public Finance Network (PFN) estimating how much the tax-exemption saves issuers and borrowers in the municipal market.

Disclaimer: The following is provided to further education and research and is not intended to provide legal advice or counsel as to any particular situation. The National Association of Bond Lawyers takes no responsibility for the completeness or accuracy of this material. You are encouraged to conduct independent research of original sources of authority. If you discover any errors or omissions, please direct those and any other comments to NABL.

States and local governments are responsible for more than 90 percent of all public-sector construction spending, most of which is funded through tax-exempt municipal bonds.1 Unlike Federal Treasury bonds, which can support deficit spending, tax-exempt municipal bonds are subject to strict limitations under the Internal Revenue Code and state constitutions. As a result, they are predominantly used to fund new infrastructure projects such as roads, bridges, schools, and essential utilities like water, sewer, and power systems.

Key Findings

- The tax-exempt municipal bond market is a widely used source of capital for states, local governments, tribes, territories, infrastructure and service providers, and non-profit borrowers that finances a tremendous share of the nation’s public infrastructure.

- We estimate a global savings spread between taxable and tax-exempt municipal bonds of 210 basis points.

- We estimate the tax-exemption will save issuers / borrowers about $823.92 billion between 2026 and 2035.

- Elimination of the tax-exemption would correspondingly raise borrowing costs $823.92 billion, a cost that would be passed onto American residents and amount to a $6,554.67 tax and rate increase for every American household over the next decade.

Determining the Size of the Tax-Exempt Municipal Market

The Securities Industry and Financial Markets Association (SIFMA) estimates that the entire municipal securities market has an outstanding par value of $4.1 trillion as of Q1 2024.2 Municipal Market Analytics (MMA) analysis of Bloomberg data as of November 24, 2024 found that tax-exempt municipal securities composed approximately 84.28 percent of the total outstanding market, which leads us to estimate the par value of outstanding tax-exempt municipal securities in the market as of 2024 to be approximately $3.512 trillion. From there, we assume a 2 percent per annum growth in the market to derive the size of the outstanding tax-exempt municipal bond market for the calendar years 2023-2035.

Any large, comprehensive tax legislation in 2025 will likely pass via budget reconciliation, which requires revenue implications for the bill to be contained within a 10-year window. Assuming an effective date of January 1, 2026, and a sunset within 10-years, we chose to focus our estimations on the municipal market on calendar years 2026-2035.

Exhibit 1 | Total Par Value of Outstanding Municipal Market (in billions)

| Year | Par Value of Outstanding Municipal Market | Par Value of Outstanding Tax-Exempt Municipal Market |

|---|---|---|

| 2023 | $4,018.00 | $3,375.12 |

| 2024 | $4,100.00 | $3,444.00 |

| 2025 | $4,182.00 | $3,512.88 |

| 2026* | $4,265.64 | $3,583.14 |

| 2027 | $4,350.95 | $3,654.80 |

| 2028 | $4,437.97 | $3,727.90 |

| 2029 | $4,526.73 | $3,802.45 |

| 2030 | $4,617.27 | $3,878.50 |

| 2031 | $4,709.61 | $3,956.07 |

| 2032 | $4,803.80 | $4,035.19 |

| 2033 | $4,899.88 | $4,115.90 |

| 2034 | $4,997.88 | $4,198.22 |

| 2035 | $5,097.83 | $4,282.18 |

Calculating the Global Savings Spread

In order to determine the average spread between taxable and tax-exempt bonds, we rely on data from The Municipal Market Monitor (TM3) indices offered by Refinitiv. Spread data on 10-year bonds from 249 days in CY2023 were averaged to reach the following spreads across four ratings categories: AAA, AA, A, and BAA. We then used the market share of each rating, as determined by analysis from Municipal Market Analytics, Inc. (MMA), to develop a weighted formula that approximates a market-wide spread to serve as the basis for our findings. Only investment grade ratings were considered for these calculations, and market shares are based on the portion of the investment grade market rated at each rating.

While the omission of spreads and market shares for unrated and below-investment grade bonds likely represents a small portion of the market, it is important to acknowledge that their spreads likely exceed those of investment-grade bonds. Consequently, excluding these bonds may lower the calculated global spread, resulting in a more conservative estimate. Using our weighted formula, we estimate a global average spread between taxable and tax-exempt municipal bonds of 210 basis points. In practical terms, this means the tax exemption on municipal bonds reduces borrowing costs for municipal issuers by an average of 2.10 percentage points.

Exhibit 2 | Average Spreads Between Taxable and Tax-Exempt Bonds Per Rating Category

| Ratings | Market Share | Weight | Spread Approximation (bp) | Formula Result |

|---|---|---|---|---|

| AAA | 20.2% | 0.20 | 200 | 40.00 |

| AA | 58.8% | 0.59 | 207 | 122.13 |

| A | 17.5% | 0.18 | 222 | 39.96 |

| BBB and under | 2.9% | 0.03 | 248 | 7.44 |

| Total Investment Grade | 99.4% |

| Below Investment Grade | 0.9% |

| Total Share of Rated Market Excluded | 0.9% |

| Global Spread (bp) | 209.53 | |||

| Global Spread (%) | 2.10% |

Exhibit 3 | Global Spread Formula

0.20(AAA Spread) + 0.59(AA Spread) + 0.18(A Spread) + 0.03(BBB Spread) = Global Spread

0.20(200 bp) + 0.59(207 bp) + 0.18(222 bp) + 0.03(248 bp) = Global Spread

40.00 bp + 122.13 bp + 39.96 bp + 7.44 bp = Global Spread

210 bp = Global Spread

Estimating the Nationwide Savings

With an established average spread between taxable and tax-exempt bonds, we are able to estimate the

total savings to issuers and conduit borrowers of tax-exempt municipal bonds over various periods of time by multiplying the projected outstanding tax-exempt market size for each year by our global savings spread of 2.10 percent. It is worth noting that we assume the global savings spread remains constant at 2.10 percent. While macroeconomic conditions and Federal Reserve actions will likely cause the global spread to fluctuate over the covered years, our finding of 210 bp is in congress with long term municipal market trends.

We estimate a cumulative nationwide savings to tax-exempt issuers and borrowers of $823.92 billion between 2026 and 2035. From there we determined the savings, and therefore cost increase in the event of the tax-exemption elimination, per US household, taxpayer, and resident using estimated values from the Census Bureau and Tax Foundation.

Exhibit 4 | Estimated Nationwide Savings to Issuers / Borrowers of Tax-Exempt Municipal Bonds (in billions)

| Year | Par Value of Tax-Exempt Municipal Market | Savings Spread (%) | Estimated Savings | Cumulative Savings |

|---|---|---|---|---|

| 2023 | $3,375.12 | 2.10% | $70.88 | — |

| 2024 | $3,444.00 | 2.10% | $72.32 | — |

| 2025 | $3,512.88 | 2.10% | $73.77 | — |

| 2026* | $3,583.14 | 2.10% | $75.25 | $75.25 |

| 2027 | $3,654.80 | 2.10% | $76.75 | $152.00 |

| 2028 | $3,727.90 | 2.10% | $78.29 | $230.28 |

| 2029 | $3,802.45 | 2.10% | $79.85 | $310.13 |

| 2030 | $3,878.50 | 2.10% | $81.45 | $391.58 |

| 2031 | $3,956.07 | 2.10% | $83.08 | $474.66 |

| 2032 | $4,035.19 | 2.10% | $84.74 | $559.40 |

| 2033 | $4,115.90 | 2.10% | $86.43 | $645.83 |

| 2034 | $4,198.22 | 2.10% | $88.16 | $734.00 |

| 2035 | $4,282.18 | 2.10% | $89.93 | $823.92 |

$823.92 B

10-Year projected savings to American communities (2026-2035) as a result of the tax-exemption.

Exhibit 5 | Estimated Costs of Elimination of the Tax-Exemption to Americans

| Estimated Population | Cost Burden | |

|---|---|---|

| Per US Household 3 | 125.7 million | $6,554.67 |

| Per US Taxpayer4 (2021) | 153.6 million | $5,364.07 |

| Per US Resident Per US Household 3 | 334.9 million | $2,460.20 |

Borrowing Absent the Tax-Exemption

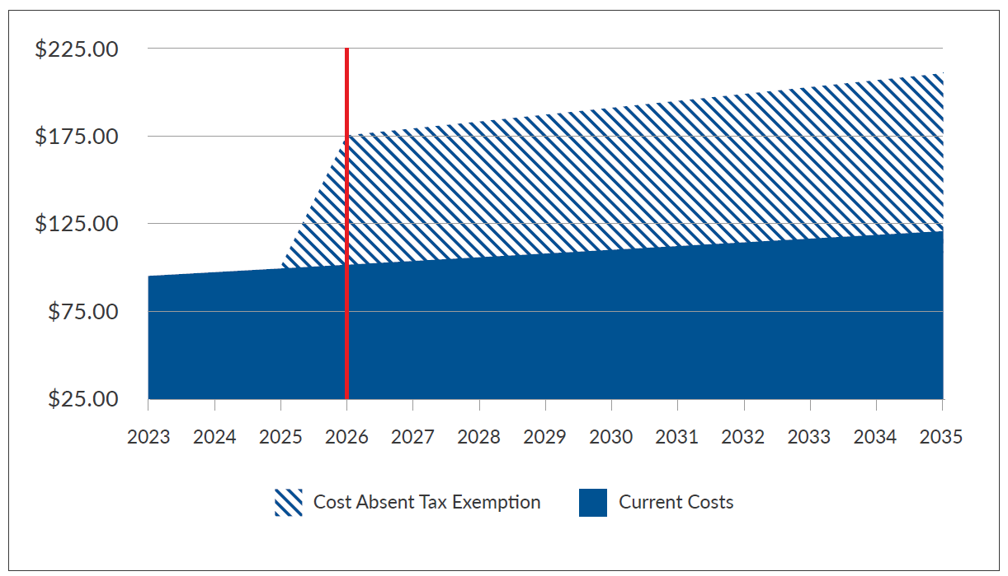

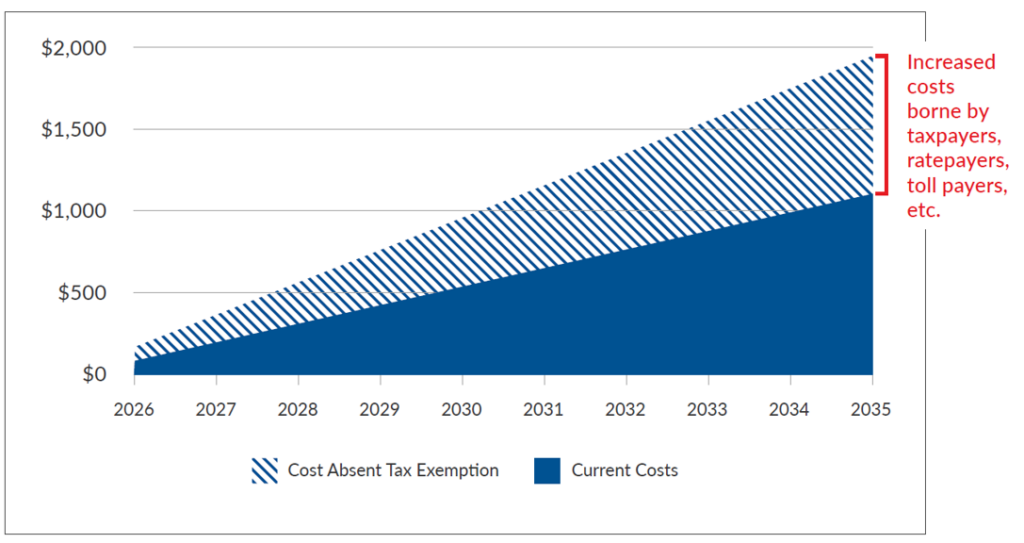

Based on the CY2023 issuance data, we determined the average taxable issuance rate, similarly weighted by bond rating, to be 4.92 percent and the average tax-exempt rate to be 2.83 percent. Using these average yields for municipal bonds we were able to project the anticipated 10-year (2026-2035) cumulative borrowing costs to municipal issuers and borrowers in the event the tax-exemption stays in place ($1.11 trillion) and in the event the tax-exemption is eliminated ($1.93 trillion). These figures likely

fall short of the true additional borrowing cost increase resulting from the elimination of the tax-exemption as they do not include the increased cost to municipal issuers and borrowers that would result from private placement loans converting to taxable in the event the tax-exemption is eliminated.

$1.11 Trillion

Projected cumulative

borrowing costs to municipal

issuers and borrowers if

tax-exemption stays in place.

$1.93 Trillion

Projected cumulative

borrowing costs to municipal

issuers and borrowers if

tax-exemption is eliminated.

Exhibit 6 | Projected Borrowing Costs in the Event the Tax-Exemption Stays in Place (in billions)

| Year | Par Value Outstanding T/E Municipal Market | T/E Rate | Borrowing Cost | Cumulative Costs |

|---|---|---|---|---|

| 2023 | $3,375.12 | 2.83% | $95.52 | |

| 2024 | $3,444.00 | 2.83% | $97.47 | |

| 2025 | $3,512.88 | 2.83% | $99.41 | |

| 2026* | $3,583.14 | 2.83% | $101.40 | $101.40 |

| 2027 | $3,654.80 | 2.83% | $103.43 | $204.83 |

| 2028 | $3,727.90 | 2.83% | $105.50 | $310.33 |

| 2029 | $3,802.45 | 2.83% | $107.61 | $417.94 |

| 2030 | $3,878.50 | 2.83% | $109.76 | $527.70 |

| 2031 | $3,956.07 | 2.83% | $111.96 | $639.66 |

| 2032 | $4,035.19 | 2.83% | $114.20 | $753.86 |

| 2033 | $4,115.90 | 2.83% | $116.48 | $870.34 |

| 2034 | $4,198.22 | 2.83% | $118.81 | $989.15 |

| 2035 | $4,282.18 | 2.83% | $121.19 | $1,110.34 |

Projected 10-Year Borrowing Costs – $1,110.34 billion

Exhibit 7 | Projected Borrowing Costs in the Event Tax-Exemption is Eliminated (in billions)

| Year | Par Value Outstanding T/E Municipal Market | Taxable Rate | Borrowing Costs | Cumulative Costs |

|---|---|---|---|---|

| 2023 | $3,375.12 | 4.93% | $166.39 | |

| 2024 | $3,444.00 | 4.93% | $169.79 | |

| 2025 | $3,512.88 | 4.93% | $173.18 | |

| 2026 | $3,583.14 | 4.93% | $176.65 | $176.65 |

| 2027 | $3,654.80 | 4.93% | $180.18 | $356.83 |

| 2028 | $3,727.90 | 4.93% | $183.79 | $540.62 |

| 2029 | $3,802.45 | 4.93% | $187.46 | $728.08 |

| 2030 | $3,878.50 | 4.93% | $191.21 | $919.29 |

| 2031 | $3,956.07 | 4.93% | $195.03 | $1,114.32 |

| 2032 | $4,035.19 | 4.93% | $198.94 | $1,313.26 |

| 2033 | $4,115.90 | 4.93% | $202.91 | $1,516.17 |

| 2034 | $4,198.22 | 4.93% | $206.97 | $1,723.14 |

| 2035 | $4,282.18 | 4.93% | $211.11 | $1,934.25 |

Exhibit 8 | Projected Annual Borrowing Costs, 2023-2025 (in billions)

Exhibit 9 | Projected Cumulative Borrowing Costs 2026-2035 (in billions)

Supporting Partners

- Airports International Council North America (ACI-NA)

- American Public Gas Association (APGA)

- American Public Power Association (APPA)

- American Public Transportation Association (APTA)

- American Securities Association (ASA)

- American Society of Civil Engineers (ASCE)

- Association of Metropolitan Water Agencies (AMWA)

- Association of Public and Land-Grant Universities (APLU)

- Association of School Business Officials (ASBO) International

- Bond Dealers of America (BDA)

- Council of Infrastructure Financing Authorities (CIFA)

- The Council of State Governments (CSG)

- International City/County Management Association (ICMA)

- Government Finance Officers Association (GFOA)

- International Municipal Lawyers Association (IMLA)

- National Association of Bond Lawyers (NABL)

- National Association of College and University Business Officers (NACUBO)

- National Association of Clean Water Agencies (NACWA)

- National Association of Counties (NACo)

- National Association of Regional Councils (NARC)

- National Association of State Auditors, Comptrollers and Treasurers (NASACT)

- National Association of State Treasurers (NAST)

- National Association of Towns and Townships (NATAT)

- National Community Development Association (NCDA)

- National Conference Of State Legislatures (NCSL)

- National Council of State Housing Agencies (NCSHA)

- National League of Cities (NLC)

- National Special Districts Association (NSDA)

- Securities Industry and Financial Markets Association (SIFMA)

- Water Environment Federation (WEF)

Special thank you for review and data consultation to:

- Justin Marlow, University of Chicago, Center for Municipal Finance

- Dan Hartman, PFM Financial Advisors, LLC

- Matt Fabian, Municipal Market Analytics (MMA)

- Michael Stanton, Build America Mutual (BAM) Assurance Company

- Brian Egan, National Association of Bond Lawyers (NABL)

Footnotes

- U.S. Census Bureau, Construction Spending, December 2, 2024. Additional information

on the survey methodology may be found at census.gov/construction/c30/meth.html ↩︎ - Securities Industry and Financial Markets Association (SIFMA). “US Municipal Bonds Statistics.” November 1, 2024. Web Access: https://www.sifma.org/resources/research/statistics/us-municipal-bonds-statistics ↩︎

- U.S. Census Bureau. “Quick Facts United States: Population Estimates, July 1, 2023.” Web access: https://www.census.gov/quickfacts/fact/table/US ↩︎

- Tax Foundation. “Summary of the Latest Federal Income Tax Data, 2024 Update.” March 13, 2024. Web access: https://taxfoundation.org/data/all/federal/latest-federal-income-tax-data-2024/ ↩︎

- U.S. Census Bureau. “Quick Facts United States: Population Estimates, July 1, 2023.” Web access: https://www.census.gov/quickfacts/fact/table/US ↩︎