- News

LIFT Act Reintroduced in 118th Congress

The three-prong bill would restore tax-exempt advance refunding bonds, modernize the small borrower’s exemption, and implement a new direct pay bond program.

By: Brian Egan, Director of Government Affairs, NABL

On Tuesday, May 14, Rep. Terri Sewell (D-AL) reintroduced her signature bond legislation, the Local Infrastructure Financing Tools (LIFT) Act (H.R. 8396). The three-pronged bill would:

- Restore tax-exempt advance refunding bonds;

- Modernize the small borrower (“bank qualified debt”) by raising the annual threshold from $10 million to $30 million, indexing it to inflation, and applying it at the borrower level;

- Create a new direct pay bond program that would start with a 42 percent subsidy rate for bonds issued in 2024 – 2028 and would gradually ramp down to 30 percent.

Rep. Sewell, a leading member of the House Municipal Finance Caucus and a former NABL member, has introduced nearly identical versions of the LIFT Act in the past several congresses.

In response to the reintroduction of the bill, NABL offered the following quote of support:

“We applaud Congresswoman Sewell for her continued leadership on community finance issues. Each of the three pillars of the LIFT Act supports affordable finance for all kinds of communities within Alabama and throughout the United States. Restoring tax-exempt advance refunding bonds would return a tried-and-true tool for issuers to reduce their borrowing costs. Updating the small issuer exemption would provide our small and rural communities with greater access to capital.”

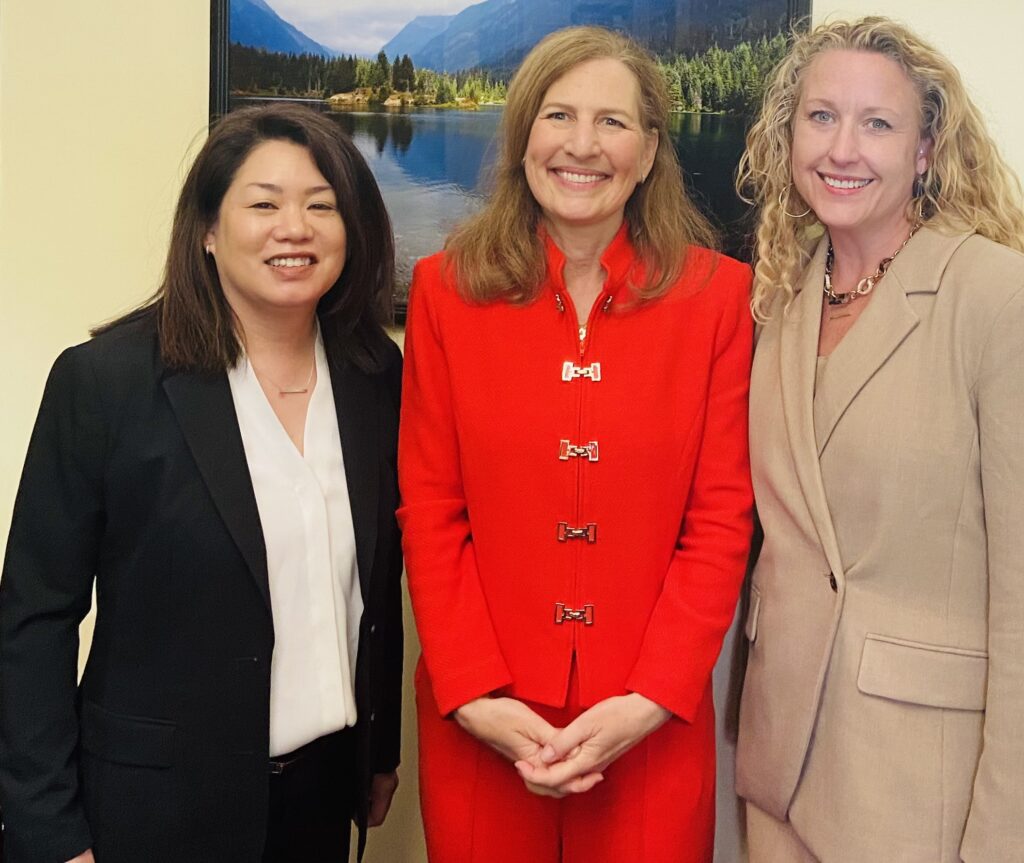

The reintroduction also coincided with the NABL Board of Directors’ annual Washington, D.C. meeting. Board members journeyed to Capitol Hill this week to highlight the importance of tax-exempt finance and to build congressional support for our priorities.

Congress is unlikely to take up a major tax package before the end of this year. Major tax legislation will, however, likely be a major subject of debate for the next Congress as we near the expiration of Tax Cuts and Jobs Act provisions at the end of 2025. Building and maintaining support for tax-exempt finance remains a major priority for NABL and other public finance groups in Washington, D.C.